The US Has the World's Highest Economic Losses From Weather Events

A new Swiss Re study ranks the US second in terms of percent of GDP economic losses

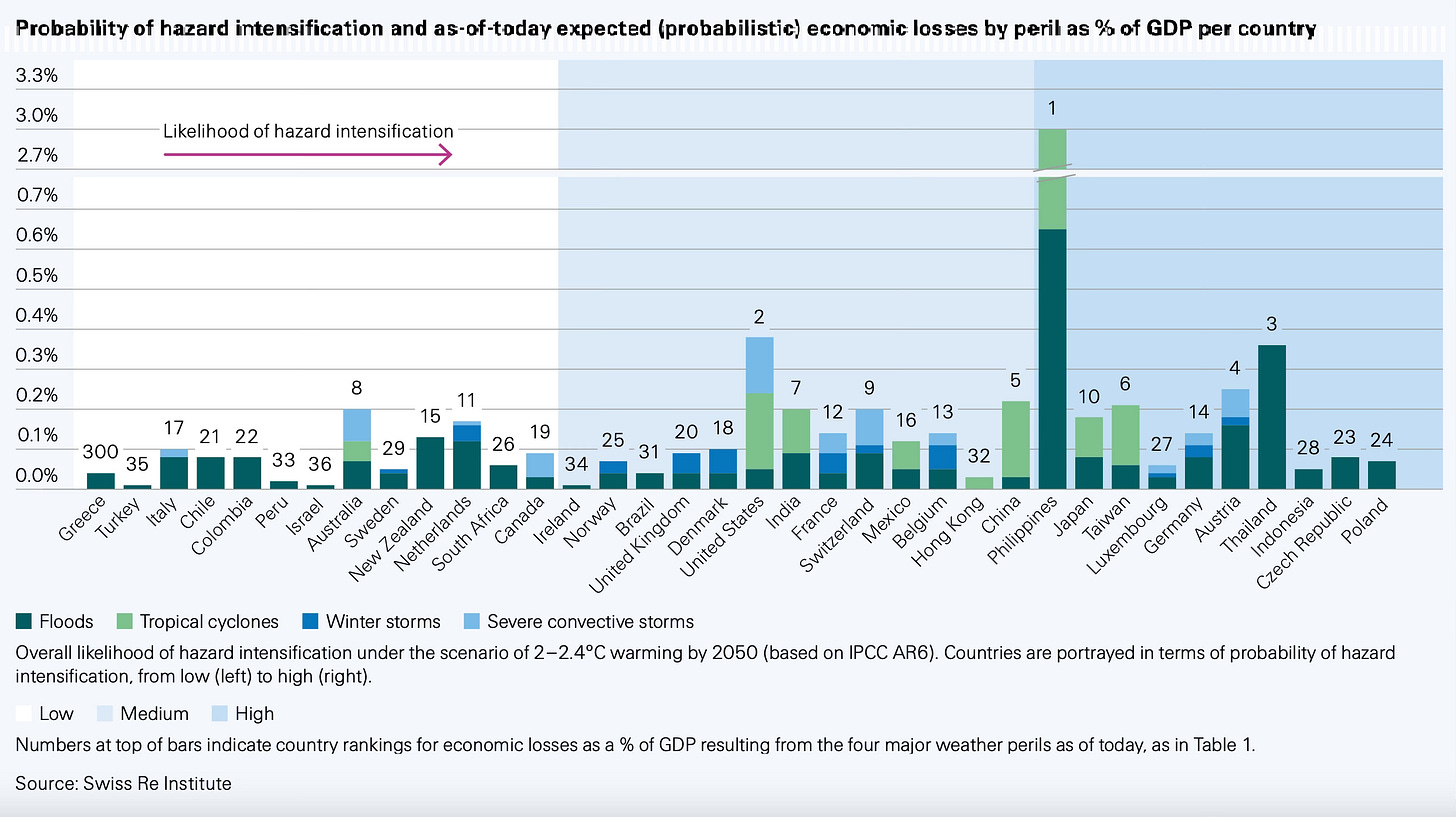

A recent publication by Swiss Re Institute, "Changing climates: the heat is (still) on," revealed alarming projections regarding the economic toll of extreme weather events worldwide. This study, which focuses on property damage across 36 countries, highlights the growing vulnerability of nations to the impacts of climate change-induced disasters.

The actual number is undoubtedly even higher than an annual bill of 200 billion dollars, which is close to the national product of a country like Greece. The recent report focused on the economic loss potential across only 36 countries and limited the risk landscape to the impact of only four kinds of extreme weather perils.

The study links climate change to hazard intensification and estimates how this intensification can impact the countries included in the study from an economic loss point of view.

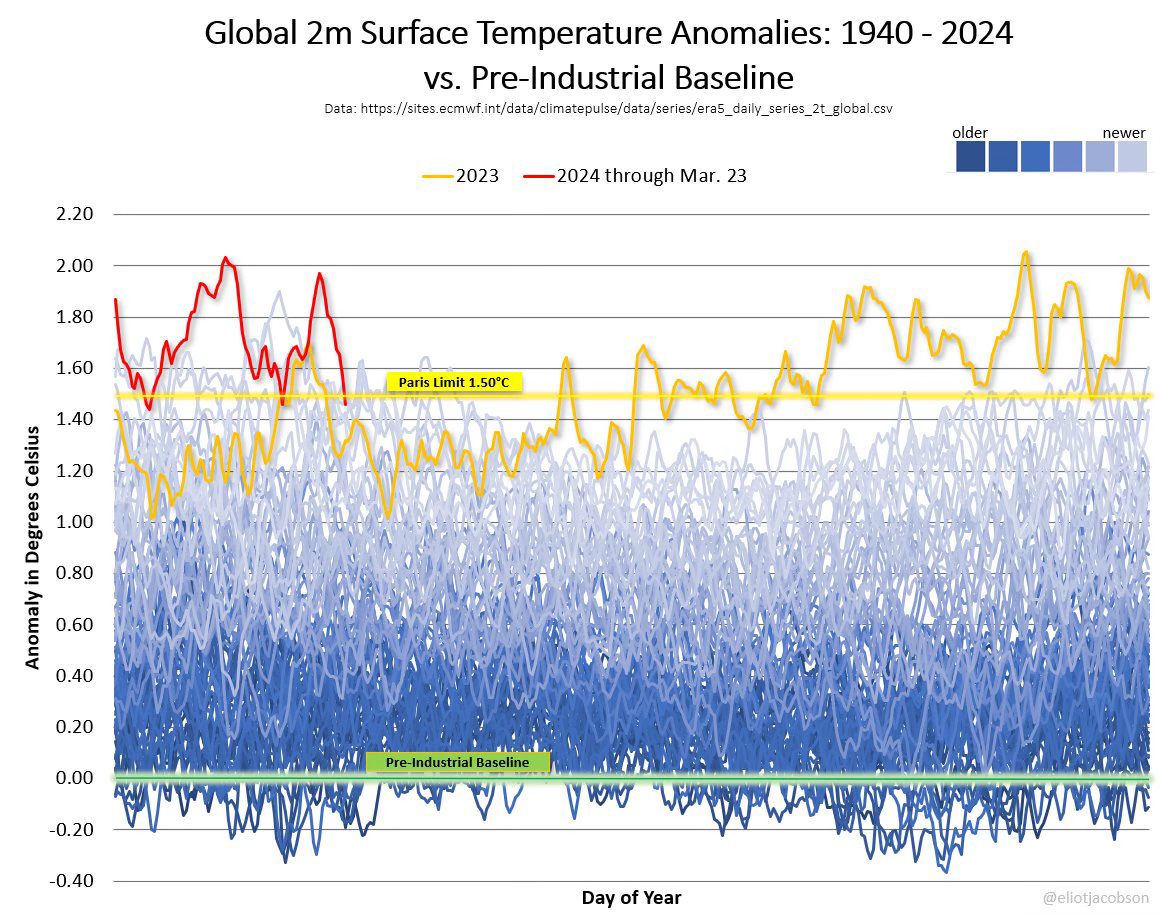

Long-term warming trend

Every day, I follow a graph of the global atmospheric temperature. It is a good indicator of climate change, directly impacting the severity of most extreme weather events. The graph shown in this article is the latest version, and it shows the long-term warming trend and the extreme increase in warming we have experienced for about a year.

Although the short-term increase still falls within the equally worrying long-term trend lines, and El Niño's fingerprints are visible, I can't remember having seen such an extreme increase in global warming since I got involved in climate change several decades ago.

WMO’s “Red Alert”

International climate and policy institutions closely follow this trend, and alarm bells are ringing all around the globe. The latest warning came from the World Meteorological Organization; in late March, it issued a 'Red Alert' on the climate crisis, citing unprecedented increases in both the causes of climate change and many of the impacts, like warming oceans or melting ice sheets.

In the "Changing climates" report, Swiss Re combined the reinsurer's unique expertise in natural disaster damage with scientific evidence from the IPCC on the probability of more severe weather conditions. Understanding how climate change could alter the risk landscape is essential for Swiss Re to support and advise their clients.

However, Swiss Re's reports and activities in the field of climate change go beyond risk analysis. Many years ago, the multinational became one of the first to raise the alarm about climate change. Swiss Re has continued to play an influential role in the climate discourse as a voice representing the business community. As a reinsurer, they saw early on the combined impact of climate-related disasters worldwide before most other companies took scientists' warnings about the looming climate crisis seriously.

Warnings in dollars are harder to ignore

I first contacted Swiss Re at a meeting in Vienna, probably around 2008. One of the reinsurer's researchers compared the increase in worldwide losses due to natural disasters. This clearly showed the increasing impact of climate-related disasters in a clarity I hadn't seen from climate researchers who worked with different data. But in a world where money is a powerful force, warnings in dollars instead of CO2 molecules were hard to ignore.

I worked as a diplomat on environmental issues in those days. I focused on various topics, including the water perspective, since droughts or floods are often related to climate and human security. In later years, when I was active in various roles in think tanks or as a public speaker and publicist on climate change's impact on security, I continued to follow Swiss Re's publications.

About twelve years ago, my focus shifted to combining human and international security in the rapidly changing global environmental conditions; these planetary security issues will further intensify in our lifetimes and increasingly become part of geopolitical developments.

Seeing climate change through a security lens brought me back to reinsurance since the global rise in financial risks directly relates to these developments. Swiss Re's analysis reports bring in an essential business perspective that covers implications beyond the focus on property loss. Their 2021 report, "The Economics of Climate Change: No Action Not an Option," is an example. It concluded that, with the current trajectory of global warming, the world risks losing up to 7–10% of its GDP by the mid-century.

In the latest report, the spotlight is on the countries where risk intensification coincides with high levels of economic exposure. The country with the worst combination of these two factors is the Philippines, where annual economic losses from weather events as a percentage of GDP are extreme compared to all other countries.

You may remember the viral video released during the United Nations COP19 climate talks of the Philippines representative crying when speaking after a typhoon had struck the country; since then, more devastating typhoons have hit the country, which should have been once-in-a-hundred-year events. Worse, the Philippines is also exposed to a high probability of risk intensification.

The second country on the list may surprise you: the United States. The US has the world's highest economic losses from weather events. That is in absolute terms; in relative terms, the Philippines is eight times worse off. The US's second-place ranking is due to the combination of its highest losses with a ranking in the medium probability category for experiencing more intense hazards.

Part of being ready for the impacts of climate change is having proper societal resilience. Swiss Re found that important global growth engines like China and India were among the least prepared to face the rising losses from hazard intensification. These countries feature in the top 10 of countries likely to be most affected by hazard intensification. This list, a summary of the report, and access to the full report are available via this link.

And at the same time that this study is published by Swiss Re, the Florida legislature sends a bill to Governor Ron DeSantis that would ban offshore wind energy, relax natural gas pipeline regulations, and delete most mentions of climate change from state laws. And this in a state that is on the front lines when it comes to the impact of extreme weather events. So many people have become such true believers in their make believe reality that I don't think they will come around even when they can no longer afford (or even get) insurance and they lose their homes or see their neighbors/family suffer due to an extreme weather event. But I guarantee they will have their hands out and be screaming and crying for federal disaster assistance. It is hard to fathom how we have arrived at this point in human history.

We have climate catastrophes and business and governance refuse to move toward remedies. They won't until climate chaos directly impacts them at home. I don't see any other reason to believe otherwise.